Pros and Cons of Payment Plans for Technology

Hardware purchases are a crucial piece of your business and its IT strategy. There are different payment options available when purchasing hardware, and you want to be prepared so you can make the best decision for your business.

In this article, we will discuss payment plans, their advantages and their disadvantages. Just for clarity’s sake, this article will use “payment plan” when referring to any type of leasing, financing, or renting. There are nuances between these different purchasing options, but this article will provide a high-level overview of the general concept.

Pros of Payment Plans

Improved Cash Flow

One of the biggest advantages of choosing a payment plan is the ability to preserve cash. Instead of paying a large lump sum upfront, you can spread the cost over time. This gives you the flexibility to allocate your cash to other important areas of your business.

Preserved Credit Lines

Financing or leasing allows you to keep your bank credit lines intact while creating a new credit source. This is especially helpful for businesses that are still in their growth phase and need access to flexible capital for unexpected opportunities or emergencies.

Predictable Budgeting

With a consistent monthly payment, you can more accurately forecast your business expenses. This helps with budgeting and planning, as you'll have a clear idea of your ongoing payments and how they fit into your overall financial strategy.

Increased Buying Power

Payment plans often allow you to acquire more or better equipment than you could if you paid for it all at once. By spreading the payments out over time, you might be able to invest in technology that improves your operations and helps your business stay competitive.

Technology Upgrades

Payment plans offer an easier way to stay on top of technology upgrades. Many plans allow you to add new equipment or upgrade existing systems with minimal impact on your monthly payments. This can keep your business at the cutting edge without requiring large capital expenditures each time a new piece of equipment is needed.

Inflation Protection

With inflation on the rise, paying for equipment over time with a fixed payment plan allows you to secure today’s technology at today’s price, even if inflation drives up costs in the future. This acts as a hedge against inflation by ensuring you lock in favorable terms for your hardware.

Cons of Payment Plans

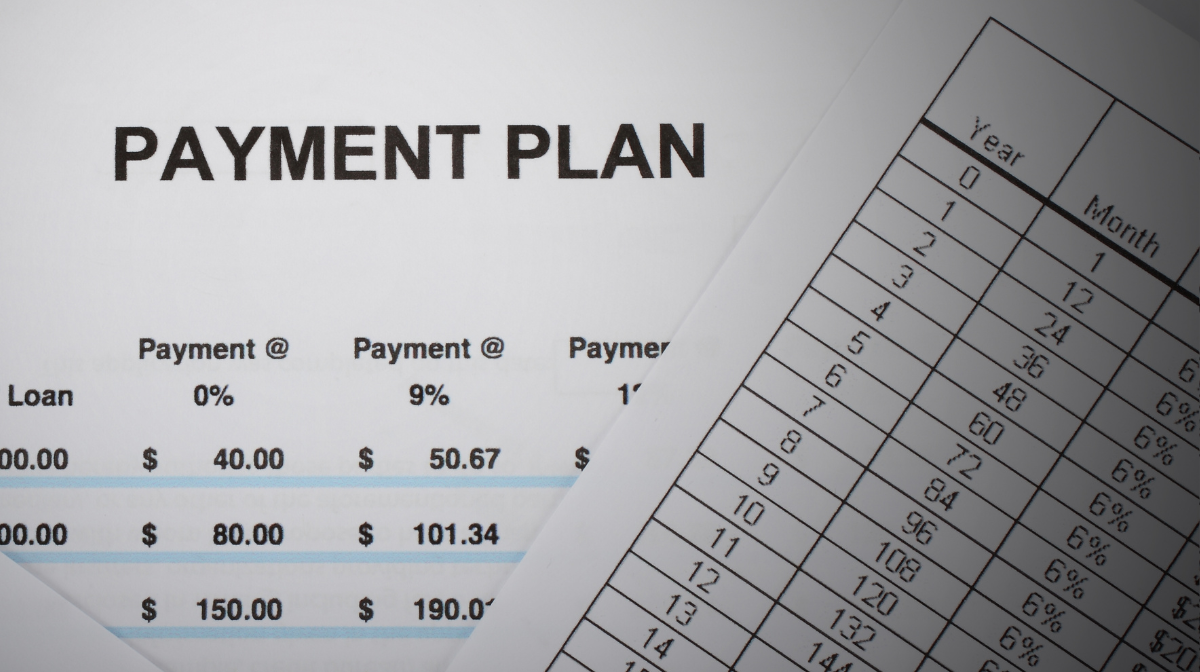

Cost of Financing

While payment plans spread out the cost of hardware, they often come with interest or fees that add to the overall expense. Depending on the terms, you may end up paying more for the equipment in the long run than if you paid for it upfront.

Buyout Costs at the End of the Term

One of the most commonly overlooked aspects of financing or leasing is the buyout option at the end of the term. Some businesses forget that they might need to pay a lump sum if they want to purchase the equipment outright at the end of the lease. Others are unaware of the buyout clause until it’s time to return the equipment, which can cause confusion and surprise costs.

Hidden Costs

Not all payment plans are created equal, and some businesses find that certain equipment, services, or features were included in the payment plan without them realizing it. For instance, things like maintenance contracts or extended warranties may be built into the plan, increasing the total cost over time. Always review the fine print before committing.

Returning Equipment

If you don't plan to buy out the equipment at the end of the payment plan, you'll be required to return it. For some businesses, this can be an inconvenience—especially if they’ve customized or heavily integrated the equipment into their daily operations. Returning equipment may also result in additional fees or penalties, depending on the agreement.

Potential Property Tax

In some cases, leased or financed equipment might be subject to property tax, depending on the nature of the agreement and your local regulations. This could add unexpected costs and affect your overall budget.

No Ownership

Perhaps one of the most significant downsides for some businesses is the fact that, with a payment plan, you don’t own the equipment outright. At the end of the term, you'll have to decide whether to buy it out, return it, or upgrade—none of which may offer the same sense of ownership as an outright purchase.

Understanding Your Business Needs and IT Strategy

Choosing whether or not to use a payment plan depends on your business's financial situation, growth plans and long-term goals. For many businesses, the benefits of a payment plan, such as improved cash flow, predictable budgeting, and the ability to acquire more advanced technology, make it an appealing option. However, it’s crucial to carefully consider the potential downsides, including the cost of financing, buyout clauses and hidden fees.

Before deciding on a payment plan, be sure to review all the terms and conditions with your vendor or MSP. A well-structured payment plan can offer great flexibility, but understanding the full scope of costs and obligations will help ensure that it aligns with your business needs and future growth.